- Order Management

- TikTok Shop

- Temu

- Amazon

- About 4Seller

- Shopify

- Inventory Management

- Amazon MCF&FBA

- Seller Tips

- Marketplace News

- Listing Management

- Amazon Shipping

- UPS

- FedEx

- DHL Express

- Creator Bulk Invite

- eBay

- GLS

- Shein

- Amazon MCF

- Inventory Sync

- Multi-channel Store

- Walmart

- Royal Mail

- Walmart WFS

- WooCommerce

- Beginner Tutorial

- Shipping Integration

- Poste Italiane

- BRT

- PayPal Tracking Sync

- ShipHero

- Shipping Label

- Stripe Tracking Sync

- UniUni

- USPS

- Yodel

- GOFO

- CIRRO

- Correos

- Correos Express

- Deutsche Post

- DHL Parcel

- Etsy

- Evri

- FBM

- OTTO

- Kaufland

- 3PL

- Logistics Rule

- CaiNiao

- Chronopost

- Cdiscount

- ShipBob

- SPU Catalog

- AliExpress

- DPD

- Request Review

- DHL

- Price Sync

- OMS

- Platform Integration

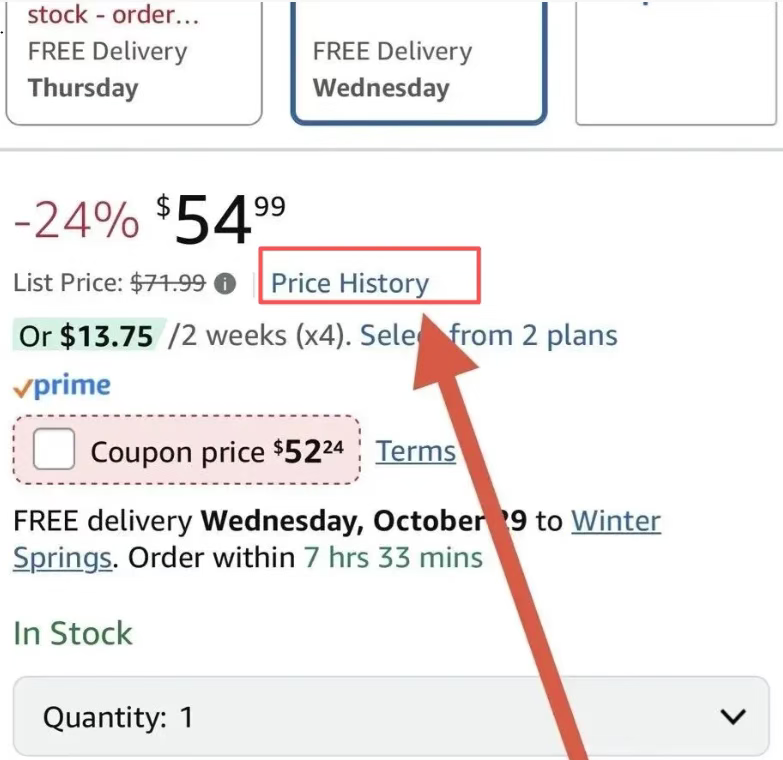

Amazon’s New “Price History” Button Signals a Shift in Deal Transparency — What Sellers & Consumers in the US & EU Need to Know

By Joline13 Nov,2025

By Joline13 Nov,2025

The e-commerce giant Amazon is quietly rolling out a new feature on its product detail pages: a native “Price History” (or similar) button that lets shoppers view a timeline of past pricing on that item. According to reports, this appears beneath the list price on mobile at least, showing 30 – 90 day history of regular price, promotional price and discount levels. (My Amazon Guy)

For consumers and sellers in both the US and Europe, this marks a meaningful shift. On one hand, buyers gain more transparency into whether a deal is “real”. On the other, sellers must reassess any pricing-promotional strategies that rely on presenting inflated list prices or temporary large “discounts”.

What the feature doesHere’s a breakdown of how the “Price History” button works, based on early observations:

-

When a shopper clicks the button (or triggers via the built-in assistant Rufus), they see a line chart covering up to ~90 days showing variations in the product’s price (regular price, promotions, discount events). (WCPO 9 Cincinnati)

-

This enables consumers to verify whether the “discount” is genuine—e.g., if the product has been at the sale price for a long-time, or if the list price was recently inflated to give the appearance of a steep drop.

-

It appears to be part of Amazon’s broader push toward pricing transparency and helping buyers feel confident they’re getting a “real deal”. (My Amazon Guy)

Why it matters for buyers

For buyers in the US and Europe, the implications are quite positive:

-

Better deal verification: Rather than having to rely on third-party tools (e.g., Keepa, CamelCamelCamel) or manually monitoring prices, the price-history graph is built in and accessible on the product page. (CamelCamelCamel)

-

More confidence in promotions: Especially during major sale events (e.g., black Friday, Cyber Monday), buyers can check if the “50% off” is genuinely the lowest price in recent weeks, or if the price was raised just before the sale to make the discount look deeper.

-

Pressure on misleading pricing: It becomes much harder for sellers to run “raise then discount” tactics without being visible to the consumer.

Why it matters for sellers

For third-party sellers on Amazon, especially in the US and European marketplaces, the new feature brings important strategic considerations:

1. Discount tactics are under spotlight

If a product has been selling at $19.99 for weeks, then the listing raises to $25.99 and offers a “23% off” drop to $19.99, the price-history graph will show the earlier consistent $19.99 level — effectively exposing the artificial discount. This may reduce the effectiveness of such tactics.

2. Transparency becomes part of trust

When consumers realise they can check price history, brands and sellers need to focus more on value-differentiation, service quality, and genuine promotions rather than solely relying on “discounting” to drive sales.

3. Planning for major sales periods changes

This rollout appears at a timely moment ahead of major seasonal sales (Black Friday, Cyber Monday), meaning sellers may need to adjust inventory, promotion and pricing strategies in light of increased visibility and potential consumer scrutiny.

4. Compliance and listing risk

As Amazon emphasises truthful promotions and price transparency, sellers engaging in inflated list prices or “raise-then-discount” strategies may face lower conversion, customer trust issues, or even algorithmic consequences in listings (e.g., Buy Box eligibility). According to one industry post:

“If your ‘lightning deal’ is not a true historical low, shoppers will know instantly… pricing integrity becomes more important.” (My Amazon Guy)

Actionable advice for Amazon sellers in US & Europe

Here are practical steps sellers should consider based on this change:

-

Review your pricing history: Check whether your regular list price has been consistent or if you have previously raised it just ahead of a promotion. The chart may now expose that.

-

Avoid artificial price inflation: Keeping consistent, transparent base pricing helps build trust and avoids red-flags for savvy shoppers.

-

Use real promotional value: If offering discounts, ensure they represent genuine savings compared to recent history.

-

Monitor inventory and timing: With increased transparency, promotions that rely purely on “urgency + discount” may lose effectiveness; focus on managing inventory, avoiding over-stock or long-term storage costs.

-

Focus on other value levers: With pricing transparency higher, aspects like product differentiation, bundle offers, enhanced product content, shipping & service become even more important.

-

Prepare for increased scrutiny in major sale events: Given this rollout ahead of peak season, sellers should plan promotions with genuine value rather than relying on large nominal discounts that aren’t backed by history.

Implications for the European market

While much of the commentary so far appears US-focused, the rollout and implications apply equally to Europe:

-

European consumers are increasingly savvy about deal authenticity; the visible price history will further shift power toward informed buyers.

-

Sellers operating on Amazon Europe platforms (UK, Germany, France, etc.) should note that pricing strategies must consider this transparency.

-

In Europe, consumer protection laws around advertising discounts and reference prices are relatively stricter — visible price history aligns with regulatory trends, making compliance even more important.

Conclusion

The introduction of a native “Price History” button on Amazon product pages marks a clear evolution in pricing transparency. For consumers, this is good news: you now have one more tool to assess whether a deal is legitimate. For sellers, particularly in the US and European marketplaces, it signals a need to shift away from purely promotional, discount-based tactics and move toward sustainable pricing strategies, genuine value delivery, and operational excellence.

As Amazon continues to emphasise transparency, sellers who adapt their approach accordingly will be better positioned—and those who don’t may find their discount tactics exposed and less effective.

- Order Management

- TikTok Shop

- Temu

- Amazon

- About 4Seller

- Shopify

- Inventory Management

- Amazon MCF&FBA

- Seller Tips

- Marketplace News

- Listing Management

- Amazon Shipping

- UPS

- FedEx

- DHL Express

- Creator Bulk Invite

- eBay

- GLS

- Shein

- Amazon MCF

- Inventory Sync

- Multi-channel Store

- Walmart

- Royal Mail

- Walmart WFS

- WooCommerce

- Beginner Tutorial

- Shipping Integration

- Poste Italiane

- BRT

- PayPal Tracking Sync

- ShipHero

- Shipping Label

- Stripe Tracking Sync

- UniUni

- USPS

- Yodel

- GOFO

- CIRRO

- Correos

- Correos Express

- Deutsche Post

- DHL Parcel

- Etsy

- Evri

- FBM

- OTTO

- Kaufland

- 3PL

- Logistics Rule

- CaiNiao

- Chronopost

- Cdiscount

- ShipBob

- SPU Catalog

- AliExpress

- DPD

- Request Review

- DHL

- Price Sync

- OMS

- Platform Integration

- 17 Dec,2024

- 17 Dec,2024