- Order Management

- TikTok Shop

- Temu

- About 4Seller

- Amazon

- Shopify

- Inventory Management

- Amazon MCF&FBA

- Seller Tips

- Listing Management

- Amazon Shipping

- UPS

- FedEx

- DHL Express

- Creator Bulk Invite

- Marketplace News

- eBay

- GLS

- Shein

- Amazon MCF

- Inventory Sync

- Multi-channel Store

- Royal Mail

- Walmart

- Walmart WFS

- Shipping Integration

- Beginner Tutorial

- WooCommerce

- PayPal Tracking Sync

- Poste Italiane

- BRT

- ShipHero

- Shipping Label

- Stripe Tracking Sync

- UniUni

- USPS

- Yodel

- FBM

- Chronopost

- CIRRO

- Correos

- Correos Express

- Deutsche Post

- DHL Parcel

- Etsy

- Evri

- OTTO

- GOFO

- CaiNiao

- Kaufland

- 3PL

- Logistics Rule

- ShipBob

- SPU Catalog

- DPD

- AliExpress

- DHL

- Request Review

- Price Sync

- OMS

- Platform Integration

- Cdiscount

New EU €3 Customs Duty for Low-Value E-Commerce Parcels in 2026: What European Sellers Need to Know

By Joline17 Dec,2025

By Joline17 Dec,2025

From 1 July 2026, the European Union will introduce a fixed €3 customs duty on all parcels valued below €150 entering the EU from third countries, primarily via e-commerce channels. The measure, agreed by the Council, is designed as a temporary solution to address unfair competition, customs fraud, consumer safety risks, and environmental concerns associated with the current duty-free regime for low-value parcels.

This article provides a structured analysis of the policy background, implementation rules, and its practical implications for European e-commerce sellers, with a focus on competition dynamics, cost structures, and strategic opportunities ahead of the EU’s broader customs reform.

1. Overview of the EU €3 Small Parcel Customs Duty (Effective 2026)

The Council of the European Union has agreed that, starting from 1 July 2026, all small consignments with a declared value below €150 entering the EU from non-EU countries will be subject to a fixed €3 customs duty per item.

The measure applies primarily to goods sold via e-commerce platforms and is explicitly framed as a temporary arrangement. It will remain in force until the EU’s permanent system for low-value parcels, agreed politically in November 2025, comes into application. Under that permanent framework, the existing customs duty relief threshold of €150 will be eliminated entirely.

The policy represents a significant shift in how the EU regulates cross-border e-commerce imports.

2. Why the €150 Duty-Free Threshold Became Unsustainable?

The EU’s exemption from customs duties for parcels valued under €150 was originally intended to simplify customs procedures and reduce administrative costs. However, the rapid growth of global e-commerce has fundamentally altered how this exemption is used in practice.

According to data from the European Commission, more than 4.1 billion parcels valued below €150 entered the EU in 2024, a figure that doubled compared to the previous year. Ninety-one percent of these parcels originated from China, largely driven by the expansion of large cross-border platforms.

At the same time, the Commission estimates that up to 65% of low-value parcels are undervalued at declaration, allowing sellers to avoid customs duties and distort competition. The resulting impact has been multifaceted: pressure on EU-based sellers, increased customs fraud, growing consumer safety concerns, and a significant environmental footprint linked to parcel fragmentation and long-distance shipping.

Against this backdrop, EU policymakers concluded that the existing exemption no longer reflects market reality.

3. How the €3 Fixed Customs Duty Will Be Applied?

3.1 Scope of Application and IOSS Coverage

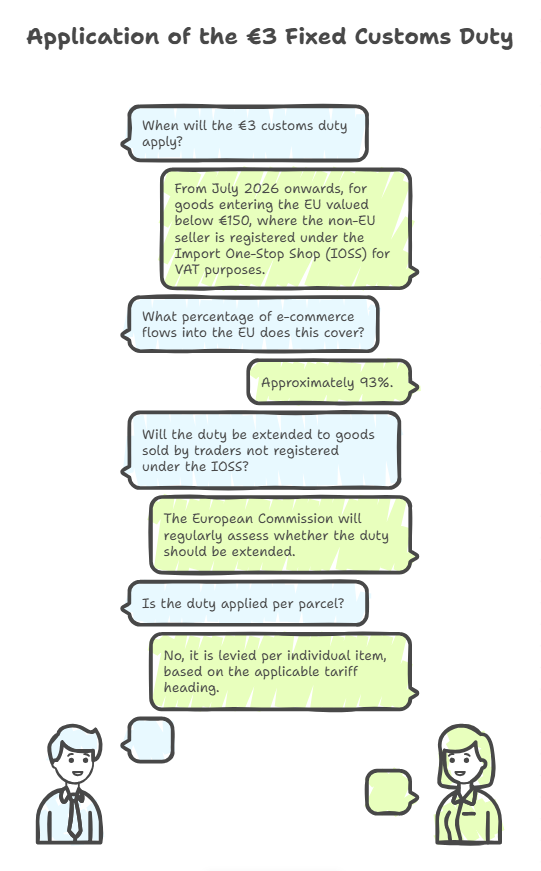

From July 2026 onwards, the €3 customs duty will apply to all goods entering the EU in consignments valued below €150 where the non-EU seller is registered under the Import One-Stop Shop (IOSS) for VAT purposes.

According to the Council, this scope covers approximately 93% of all e-commerce flows into the EU, ensuring that the measure affects the vast majority of low-value cross-border transactions.

The European Commission has indicated that it will regularly assess whether the duty should be extended to goods sold by traders not registered under the IOSS.

3.2 Per-Item Assessment Based on Tariff Headings

The duty is not applied per parcel as a flat shipment fee. Instead, it is levied per individual item, based on the applicable tariff heading contained within a consignment.

This technical detail is significant, as it directly addresses practices involving the bundling and splitting of shipments to minimise effective customs costs.

3.3 Distinction from the Proposed “Handling Fee”

The €3 customs duty is legally and conceptually distinct from the proposed so-called “handling fee”, which is still under discussion as part of the EU’s broader customs reform package and the multiannual financial framework.

While both measures aim to strengthen customs oversight, the handling fee proposal has not yet been approved and may follow a separate legislative timeline.

4. A Temporary Measure Responding to an Urgent Problem

EU institutions have repeatedly stressed that the €3 duty is an interim solution.

In November 2025, member states committed to eliminating the €150 customs duty relief threshold altogether. However, implementing a permanent system requires substantial technical and legislative preparation, pushing full application towards 2028.

Given what the Commission describes as an urgent and rapidly escalating problem, the fixed €3 duty is intended to restore a degree of fairness and regulatory control in the interim period.

Once the permanent system enters into force, all goods below €150 will become subject to standard EU customs tariffs applicable to individual product categories.

5. Implications for European E-commerce Sellers

5.1 Reduced Advantage of Ultra-Low-Price Cross-Border Models

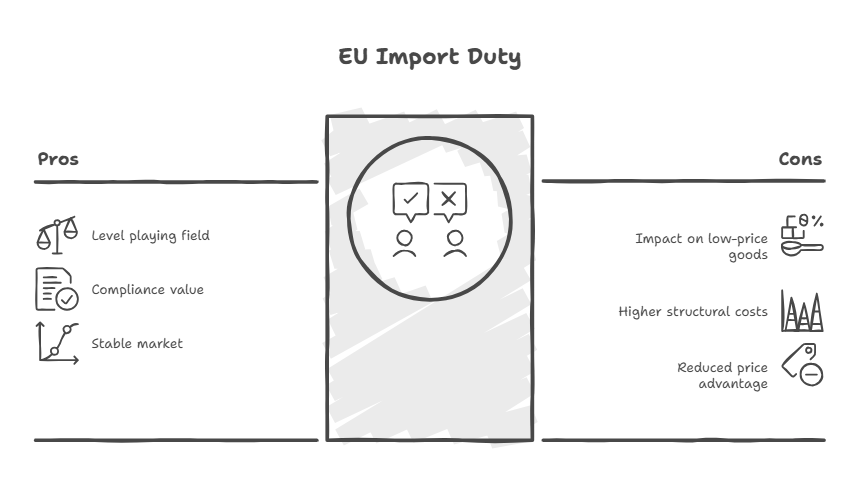

A fixed €3 duty has a disproportionate impact on very low-priced goods. For items sold at only a few euros, the additional cost fundamentally alters profit margins, while products in the mid-price range are far less affected.

As a result, business models built primarily on ultra-low prices, parcel fragmentation, and scale-driven advertising are likely to face higher structural costs when selling directly into the EU from third countries.

5.2 Revaluation of Compliance and Local Fulfilment

European sellers typically bear costs related to VAT compliance, product safety certification, local warehousing, and customer service. Under the previous regime, these obligations often translated into a competitive disadvantage compared to direct-to-consumer imports from outside the EU.

The new duty does not eliminate competition, but it partially corrects a long-standing asymmetry. Compliance, local fulfilment, and consumer trust begin to regain measurable economic value.

5.3 Market Example: Mid-Priced Goods Gain Relative Stability

Consider a France-based home goods retailer selling products priced between €40 and €90, fulfilled from EU warehouses and fully compliant with EU product regulations. While the company previously struggled to compete with ultra-low-priced imports, the €3 duty has minimal impact on its core assortment.

In contrast, its advantages in delivery speed, returns handling, and regulatory transparency become more visible to consumers as price gaps narrow at the lower end of the market.

6. Limitations and Ongoing Risks

The policy should not be interpreted as blanket protection for EU sellers. Large global platforms retain significant adaptive capacity, including the ability to establish EU-based fulfilment, absorb part of the cost, or restructure logistics networks.

Moreover, part of the duty may ultimately be passed on to consumers, increasing price sensitivity across certain segments. Sellers lacking differentiation or brand trust may still face margin pressure.

Finally, the €3 duty forms part of a broader and evolving customs reform agenda. Additional regulatory measures and fees may follow, adding further complexity to the operating environment.

7. Conclusion: A Regulatory Correction, Not a Market Guarantee

The EU’s decision to apply a €3 customs duty on low-value e-commerce parcels represents a technical correction to a system that no longer functioned as intended, rather than a simple act of trade protectionism.

While the measure does not guarantee improved outcomes for European sellers, it reduces long-standing distortions and signals a shift toward greater regulatory accountability in cross-border e-commerce.

In the medium term, competitive advantage will continue to depend on product value, operational efficiency, regulatory compliance, and consumer trust. The rules are changing, but the fundamentals of competition remain.

- Order Management

- TikTok Shop

- Temu

- About 4Seller

- Amazon

- Shopify

- Inventory Management

- Amazon MCF&FBA

- Seller Tips

- Listing Management

- Amazon Shipping

- UPS

- FedEx

- DHL Express

- Creator Bulk Invite

- Marketplace News

- eBay

- GLS

- Shein

- Amazon MCF

- Inventory Sync

- Multi-channel Store

- Royal Mail

- Walmart

- Walmart WFS

- Shipping Integration

- Beginner Tutorial

- WooCommerce

- PayPal Tracking Sync

- Poste Italiane

- BRT

- ShipHero

- Shipping Label

- Stripe Tracking Sync

- UniUni

- USPS

- Yodel

- FBM

- Chronopost

- CIRRO

- Correos

- Correos Express

- Deutsche Post

- DHL Parcel

- Etsy

- Evri

- OTTO

- GOFO

- CaiNiao

- Kaufland

- 3PL

- Logistics Rule

- ShipBob

- SPU Catalog

- DPD

- AliExpress

- DHL

- Request Review

- Price Sync

- OMS

- Platform Integration

- Cdiscount

- 17 Dec,2024

- 17 Dec,2024