- Order Management

- TikTok Shop

- Temu

- About 4Seller

- Amazon

- Shopify

- Inventory Management

- Amazon MCF&FBA

- Seller Tips

- Listing Management

- Amazon Shipping

- UPS

- FedEx

- DHL Express

- Creator Bulk Invite

- eBay

- Marketplace News

- GLS

- Shein

- Amazon MCF

- Inventory Sync

- Multi-channel Store

- Royal Mail

- Walmart

- Walmart WFS

- Shipping Integration

- Beginner Tutorial

- WooCommerce

- PayPal Tracking Sync

- Poste Italiane

- BRT

- ShipHero

- Shipping Label

- Stripe Tracking Sync

- UniUni

- USPS

- Yodel

- FBM

- Chronopost

- CIRRO

- Correos

- Correos Express

- Deutsche Post

- DHL Parcel

- Etsy

- Evri

- OTTO

- GOFO

- CaiNiao

- Kaufland

- 3PL

- Logistics Rule

- ShipBob

- SPU Catalog

- DPD

- AliExpress

- DHL

- Request Review

- Price Sync

- OMS

- Platform Integration

- Cdiscount

Amazon Tests Top Brand Section: How Seller Feedback Is Becoming a Core Conversion Driver

By Joline26 Jan,2026

By Joline26 Jan,2026

🚨 Amazon Makes a Major Front-End Move Again!

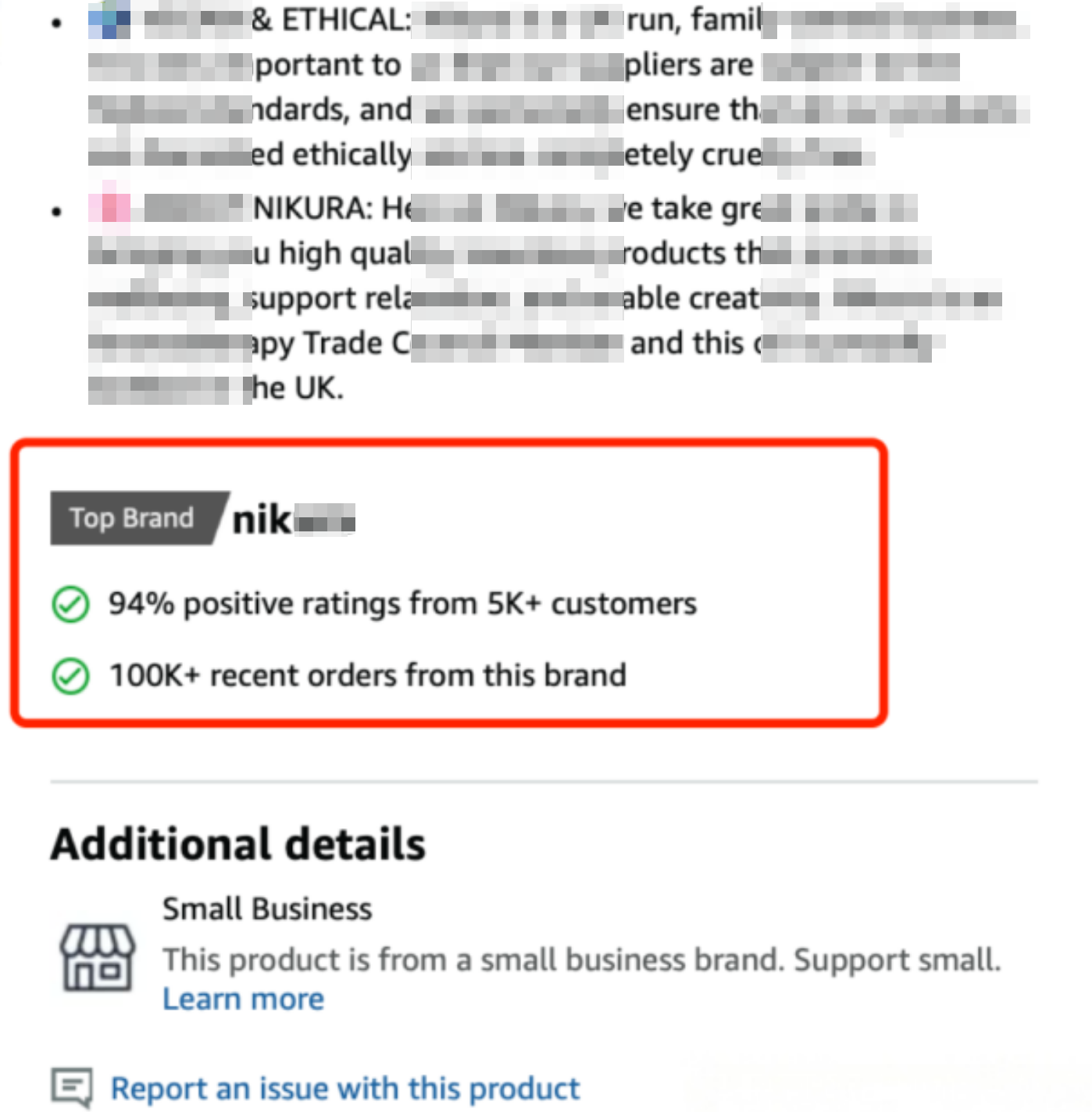

Recently, Amazon has begun testing a brand-new display module on selected product listings: the Top Brand Section.

This new module is precisely positioned directly below the bullet points (Five Bullet Descriptions) and prominently showcases key trust indicators such as store positive feedback rate, review volume, and recent order count. Consumers no longer need to scroll or click into the store page to find these critical signals. Instead, they can make faster purchase decisions right on the product page.

The launch of this module marks a fundamental shift in how Listing trust signals are displayed and prioritized.

Trust Signals Are Being Moved to the Front

Based on the latest front-end layout, the placement of the Top Brand Section is highly strategic.

On mobile devices, it appears within the first or second screen, occupying prime visual real estate directly beneath the Listing bullet points. Its priority even surpasses A+ Content and customer reviews.

As shown above, the module presents three core dimensions in a clear and intuitive way:

-

Brand Positioning – Clearly labeled as “Top Brand”

-

Reputation Metrics – For example, 94% positive ratings from 5,000+ customers

-

Order Momentum – Showing 100,000+ recent orders for the brand

Previously, buyers had to actively click into the store homepage to view this information. Now, Amazon has standardized it as part of the Listing itself, effectively pulling trust data that once lived at the bottom of the page or inside the store and pushing it directly into the core conversion path.

Put yourself in the buyer’s shoes. When you immediately see “94% positive rating + 5,000+ reviews + 100K+ recent orders,” the instinctive reaction is simple: “With this much validation, the risk of a bad purchase must be low.”

For unfamiliar brands, this data alone can eliminate most hesitation. Combined with the platform-backed Top Brand label, it signals that the brand has been filtered and recognized by Amazon as trustworthy, dramatically reducing decision risk.

For first-time brand exposure, cautious buyers, or efficiency-driven shoppers, the impact of this module is often decisive:

-

Mobile users typically spend less than 30 seconds browsing a Listing. This module eliminates the need to visit the store page or dig through reviews by compressing trust signals into the first screen.

-

The combination of high positive feedback, large review volume, and strong order momentum rapidly lowers perceived risk for unfamiliar brands, converting them into a “safe choice.”

-

For higher-priced products, the dual trust signals of platform endorsement and strong seller reputation significantly reduce payment hesitation and become a key driver of conversion.

This adjustment signals a deeper shift in Amazon’s strategy: guiding consumers away from asking “Is this product good?” toward first asking “Is this seller reliable?”

As a result, one metric is now impossible to ignore: Seller Feedback.

Seller Feedback: From Risk Control Metric to Conversion Driver

Historically, most sellers focused their operational efforts on reviews, Q&A, main images, and A+ Content. Seller Feedback was often treated merely as a back-end risk control threshold, as long as ODR stayed below 1%.

With the introduction of the Top Brand Section, the role of Seller Feedback has fundamentally changed. It has been elevated into a core Listing conversion factor.

This shift is creating clear polarization among sellers:

-

High-feedback stores (98%–100%)

The module acts as a powerful, free trust endorsement from Amazon. Especially for high-ticket items, it effectively removes buyer hesitation and unlocks significant conversion upside. -

Low-feedback stores (≤90%)

The module becomes a “negative label” on the first screen, causing users to drop off at the very first stage of the funnel. Even cold-start traffic for new products may be filtered out before meaningful engagement occurs.

In short, Seller Feedback has been pushed to the center of operations. Sellers who want to stand out in an increasingly competitive traffic environment must treat it as a core growth lever.

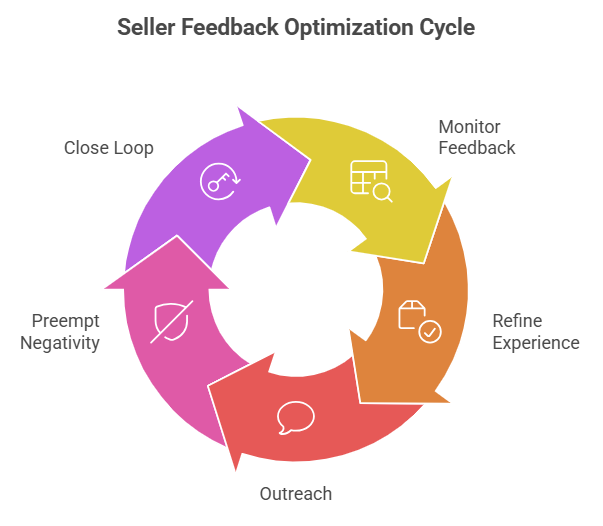

How Sellers Should Optimize Seller Feedback Operations

In response to this change, sellers should adjust their operational priorities and integrate Seller Feedback management into daily workflows:

-

Ongoing Monitoring

Track positive feedback rate and recurring keywords (logistics, packaging, after-sales) weekly. Record fluctuations in spreadsheets to avoid relying solely on delayed performance alerts. -

Refine Transaction Experience

Improve packaging integrity, instruction clarity, and response time for after-sales support.-

FBM sellers: Focus on delivery speed and tracking accuracy

-

FBA sellers: Actively monitor inbound efficiency and proactively follow up on Amazon fulfillment issues

-

-

Compliant Positive Feedback Outreach

Use Amazon-compliant messaging templates to inquire about order experience without incentivizing positive feedback, increasing exposure to satisfied customers. -

Preempt Negative Feedback

By using logistics alerts and after-sales surveys to resolve issues before feedback submission, sellers can reduce negative feedback by up to 60%. -

Close the Feedback Loop

Translate negative keywords into action. Improve packaging standards for “poor packaging” complaints or switch to faster logistics providers for “slow delivery” issues, ensuring experience optimization across the entire supply chain.

It is clear that Amazon’s algorithm continues to strengthen its emphasis on overall store performance. Seller Feedback has evolved from a passive account-protection metric into a core driver of Listing conversion and traffic allocation.

For all sellers, moving trust experience management to the front of operations is no longer optional. It is a necessary adjustment to align with platform rules and achieve sustainable long-term growth.

- Order Management

- TikTok Shop

- Temu

- About 4Seller

- Amazon

- Shopify

- Inventory Management

- Amazon MCF&FBA

- Seller Tips

- Listing Management

- Amazon Shipping

- UPS

- FedEx

- DHL Express

- Creator Bulk Invite

- eBay

- Marketplace News

- GLS

- Shein

- Amazon MCF

- Inventory Sync

- Multi-channel Store

- Royal Mail

- Walmart

- Walmart WFS

- Shipping Integration

- Beginner Tutorial

- WooCommerce

- PayPal Tracking Sync

- Poste Italiane

- BRT

- ShipHero

- Shipping Label

- Stripe Tracking Sync

- UniUni

- USPS

- Yodel

- FBM

- Chronopost

- CIRRO

- Correos

- Correos Express

- Deutsche Post

- DHL Parcel

- Etsy

- Evri

- OTTO

- GOFO

- CaiNiao

- Kaufland

- 3PL

- Logistics Rule

- ShipBob

- SPU Catalog

- DPD

- AliExpress

- DHL

- Request Review

- Price Sync

- OMS

- Platform Integration

- Cdiscount

- 17 Dec,2024

- 17 Dec,2024